Currently, considering that your insurance provider is the one in charge of sending the actual data, they tackle this charge when the declaring is done, after that they will bill you separately or include the expense to your following insurance coverage costs - insurance companies. Sometimes you may be required to have SR-22 insurance for numerous years, in which case you just pay a cost when for it to be submitted the very first time.

Be encouraged that if there is a lapsemeaning, you did not ask for the revival to be processed on timethen you will have to pay again since you will certainly need brand-new proof of insurance coverage. insurance. Typically talking, you will certainly require to have this certification of insurance coverage for 3 years. The actual length of time is contingent upon: where you live and what your state laws are, andwhy the courts required this protection of you.

If there was a less hazardous factor, it may be just 2 years. The coverage remains legitimate for as lengthy as you preserve your insurance plan. If, for any type of factor, you cancel this plan or there was a lapse in between renewals, your automobile insurance will alert your state authorities.

So, for instance, if you are asked to have SR-22 for 3 years, yet after that you cancel your insurance coverage plan after 2 years, the state will likely suspend your permit if it had been formerly suspended. They will certainly then press a figurative pause on that three year mark and once you make a decision to purchase a brand-new insurance coverage policy in the future, they will begin it up once again.

The size of time you are needed by your state to lug the insurance coverage can be extended if, throughout that time, you enter into a cars and truck accident or a website traffic violation. The Get more information courts can expand the time you need this insurance coverage, which can increase the expense of your insurance. The reason the cost goes up is because added infractions informs your insurance policy that you are a risky vehicle driver - deductibles.

Unknown Facts About Elephant Insurance - Insurance On Your Terms

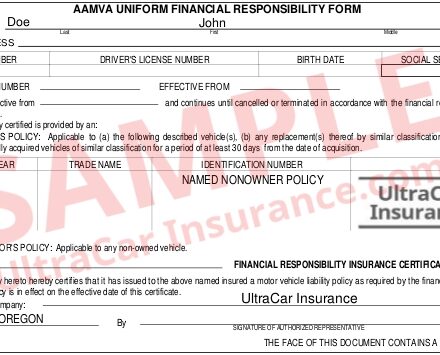

This is type SR26. If you pick an AAMVA filing online after that this will be immediately done at the end of your required time. (Mon-Fri, 8am 5pm PST) for a or fill out this kind: Finding a close to you is possible. Any insurance provider in any kind of state can supply this insurance coverage, but not every one of them do.

Also if they keep you on as a policyholder, they can elevate the cost substantially. Insurance companies determine the amount of money you pay for your coverage based on just how risk-free a chauffeur you are, which is why many people can get discounts on auto insurance by taking safe driving courses or going multiple years without offenses or having a digital device track just how safely they drive.

underinsured insurance companies coverage no-fault insurance vehicle insurance

underinsured insurance companies coverage no-fault insurance vehicle insurance

These are the top ten insurance carriers for. In order to obtain your insurance policy coverage up to day, you will need to get a quote for SR-22 insurance policy.

You can get a complimentary quote just loading the kind on the top of this web page, and also in a couple of mins you'll compare multiple cost effective SR-22 insurance quotes (sr-22). Depending upon your state, as well as the reason for your offense, you could have to file added alternate forms. SR-21 Insurance, This is a similar type yet it demonstrates that you have evidence of car insurance policy.

SR-50 Insurance, If you stay in the state of Indiana this could be the different insurance policy you are needed to lug. This is comparable and is meant to help you get your qualified renewed after it has actually been suspended due to your infraction. underinsured. (Mon-Fri, 8am 5pm PST) for a of a low-cost SR22 insurance, or fill out this type:.

9 Easy Facts About Elephant Insurance - Insurance On Your Terms Explained

ignition interlock insurance sr22 insurance department of motor vehicles sr22 insurance

ignition interlock insurance sr22 insurance department of motor vehicles sr22 insurance

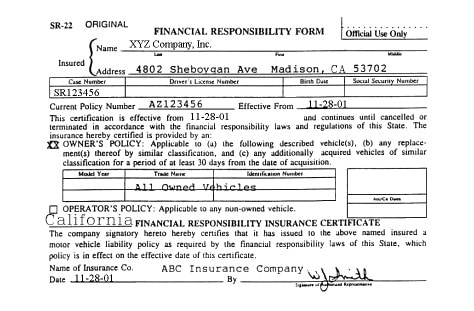

What is an SR-22? Commonly referred to as "SR-22 Insurance", an SR-22 is frequently needed for motorists that have actually had their motorist's licenses suspended due to: DUI/ DWI convictions Multiple website traffic offenses Driving without insurance policy Permit plates being ended A high variety of factors on a driving document An SR-22 is a certification of monetary duty that is filed with the Illinois Secretary of State's workplace - department of motor vehicles.

United Automobile Insurance deals same-day auto insurance. The certification notifies the State of Illinois that you have liability insurance coverage as well as if your coverage is canceled or runs out. As this can be a confusing procedure, we offered some solution to regularly asked questions pertaining to SR-22 Insurance (sr22). If you require a quote for your SR-22, please obtain a complimentary quote.

We will make certain that you have an up to date car insurance coverage policy to go along with the SR-22. Sent directly to the Illinois Assistant of State workplace as well as can take up to 30 days to procedure.

You need to initially buy Responsibility or Full Insurance coverage insurance as well as the expense will certainly depend on your age, driving document, kind of automobile, as well as extra insurance policy elements. Be sure to speak to United Auto Insurance policy for a quote on the most affordable price.

United Automobile Insurance coverage is the vehicle insurance coverage company here to aid you with your car insurance coverage needs. Responsibilities are met, the SR-22 standing will certainly be removed. At that time, it will be important to revisit your insurance policy with United Car Insurance policy and also make certain that you continue to stay covered.

How Protect Yourself With Sr22 Liability Insurance From Breathe Easy can Save You Time, Stress, and Money.

United Auto Insurance Policy is below for you in the event that you require an SR-22 certification and also insurance coverage plan. Bad things can take place to excellent individuals, so we understand that having the right group on your side to assist you clean up any type of mistakes is necessary. The very best means to deal with an SR-22 need is to call us earlier instead than later to prevent any greater dangers and also recognize that you are covered.

This details is implied for academic purposes and is not intended to change details gotten with the pricing quote procedure. This information may alter as insurance plan as well as coverage adjustment.

SR-22 Insurance can only be acquired through an insurance provider. SR-22 insurance policy has a substantial influence on your prices in The golden state, and those prices can vary substantially from one firm to an additional. Limits for An SR-22 Insurance Policy in The golden state At the minimum, you need the protection listed here if you are needed to have SR-22 insurance policy in The golden state.

sr22 coverage insure sr-22 motor vehicle safety division of motor vehicles

sr22 coverage insure sr-22 motor vehicle safety division of motor vehicles

The reason that non-owner SR-22 insurance policy is less expensive is that the insurance firm assumes that you do not drive often, and also the only coverage you obtain, in this case, is for liability only. If you lease or borrow lorries often, you should consider non-owner automobile insurance coverage too. Although prices can vary throughout insurance companies, the ordinary annual price for non-owner car insurance coverage in The golden state stands at $932.

Needs for An SR-22 in California First, comprehend that an SR-22 influences your vehicle insurance policy price and also insurance coverage. After a DUI conviction in California, common chauffeurs pay an average of 166% more than vehicle insurance coverage for SR-22 insurance coverage. The minimum duration for having an SR-22 in The golden state is 3 years, however one might need it longer than that, depending upon their instance and infraction.

The 5-Minute Rule for What Is Sr-22 Insurance Quotes?

sr-22 insurance no-fault insurance driver's license coverage insurance companies

sr-22 insurance no-fault insurance driver's license coverage insurance companies

In any one of these situations, an SR-26 type can be filed by your insurance firm. When that takes place, your insurer should indicate that you no more have insurance coverage with the entity. Beginning the SR-22 process over once more will certainly be needed if your company files an SR-26 before finishing your SR-22 requirement - department of motor vehicles.

MIS-Insurance offers cheap SR22 insurance policy that will conserve you money over the life of your plan. Budget-friendly SR22 insurance is offered and we will certainly can assist you safeguard the right policy for you. The reason is that each insurance provider uses its criteria when reviewing your driving background. deductibles. On the various other hand, California regulation forbids companies from increasing rates or terminating your plan in the center of its term.

department of motor vehicles liability insurance insurance coverage insurance no-fault insurance

department of motor vehicles liability insurance insurance coverage insurance no-fault insurance

A drunk driving will immediately increase your rates without taking into consideration additional rate rises as well as refute you price cuts even if you were previously getting a good motorist discount rate. For instance, rather than paying $100 month-to-month for cars and truck insurance coverage, a driver without any DUI background will just pay $80 monthly, thanks to the 20% excellent driver discount they obtain.

Searching for an SR22 insurance coverage guide that makes the facts clear? Affordable SR22 quotes are hard to find by due to the fact that the SR22 just uses to a very tiny portion of vehicle drivers. Vehicle drivers that have actually been located in charge of a severe traffic violation are marked "high risk" and also required to hold the SR22 as a problem of proceeding to drive. department of motor vehicles.

At Inexpensive Insurance, we understand simply how crucial it is to discover inexpensive SR22 quotes. The best quote can save you thousands of bucks a year, especially considering that SR22 can be extremely pricey. Our group is here to aid so right here are the top concerns on SR22 insurance coverage and also their responses.

What Is Sr22 Insurance? – Your Guide To Sr-22 ... - Way - Questions

Numerous smaller firms do not supply it, or supply it just at extremely high rates. Still, you should buy SR22 auto insurance policy as quickly as feasible and also make sure you have your automobile insurance card helpful whenever you drive.

No SR22 insurance coverage overview would certainly be complete without reviewing who is in fact needed to hold it - sr22 coverage. The SR22 cars and truck insurance policy recommendation is usual for: Drivers convicted of Driving While Intoxicated (DWI) or Driving Under the Impact (DUI) Anyone who has actually been located accountable for a severe lorry violation, such as a hit and also run, Individuals who engage in duplicated website traffic offenses, even if individual occurrences are small, Motorists discovered to be uninsured or under insured at the time of a crash they created, Anyone that has had their driving advantages put on hold momentarily due to a court order.

People throughout the country have actually run the risk of driving without insurance coverage and gotten involved in a crash, only to locate that they pay two or 3 times as a lot as they would certainly have for a conventional vehicle insurance plan. Plus, without car insurance you are not shielded from responsibilities developing from a mishap. coverage.

In "no mistake" auto insurance coverage states, failing to hold Injury Protection (PIP) insurance policy indicates you will certainly not have any protection for your clinical expenses, lost incomes, and other accident costs - sr22. If you fall short to obtain SR22 after being ordered to do so, penalties are very extreme as well as can even consist of jail time.

Courts commonly have wide flexibility to enforce the SR22 restriction as well as to remove it. That stated, you will typically be called for to hold it for concerning three years from the day of conviction or from the day of the qualifying crash. Several states get a notice straight from the insurance provider if you close your cars and truck insurance coverage policy or fall short to pay as well as shed your protection (department of motor vehicles).

Not known Facts About Cheap Sr 22 Auto Insurance In Missouri - Money Beagle

We wish this SR22 insurance coverage overview aids you comprehend the circumstance far better than ever before. sr22 insurance., you can compare SR22 insurance rates from lots of firms, assisting you locate the ideal bargain.