Is there a cost associated with an SR-22/ FR-44? This is an one-time fee you need to pay when we submit the SR-22/ FR-44.

A filing charge is billed for every individual SR-22/ FR-44 we submit. As an example, if your spouse is on your plan as well as both of you require an SR-22/ FR-44, after that the declaring fee will be billed two times. Please note: The fee is not consisted of in the price quote due to the fact that the filing charge can vary.

Just how lengthy is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 needs to be valid as long as your insurance plan is active. If your insurance coverage is canceled while you're still called for to bring an SR-22/ FR-44, we are called for to alert the proper state authorities. If you do not keep continual coverage you might shed your driving advantages.

motor vehicle safety motor vehicle safety deductibles credit score car insurance

motor vehicle safety motor vehicle safety deductibles credit score car insurance

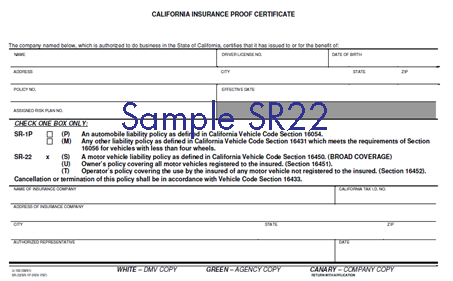

Rather, an SR-22 type is a CFR, which represents Certification of Financial Responsibility. Handing out SR-22 forms is the obligation of the Department of Motor Vehicles of the state in which the driver lives, and the process has to be arranged through them. You may require an SR-22 if you get caught committing a significant offense while you're driving.

The Buzz on Insurance Navy Names The Most Affordable ... - Xenical0i0.com

What the SR-22 in fact does is program that a chauffeur is currently satisfying the minimum insurance coverage requirements. Remember that these depend on the state that you're staying in. Considering that vehicle drivers who are convicted of certain offenses are seen as more of a danger than others, SR-22 forms make sure that other drivers are monetarily safe because these chauffeurs have their insurance coverage verified.

This documents will certainly have any kind of updates to the vehicle driver's insurance coverage policy. If the auto insurance policy protection of the driver gaps, then the DMV will find out about it as well as they will withdraw the vehicle driver's license (insure). Learn more: SR22 Insurance in California.

We suggest the course of action that works for you also if it implies less payment on our end. Selecting a company that specializes in the Florida SR22 market is critical., The Florida SR22 Insurance Policy Market is what we do and we do it extremely well.

Below are a few actions you can take to decrease your auto insurance policy prices over time: Enroll in a chauffeur's renovation training course. These training courses are an affordable investment that you can finish online, and also some states need insurance firms to offer you a discount if you complete one.

The Ultimate Guide To Elephant Insurance - Insurance On Your Terms

They contrast this to car types. In addition to the cost to fix, you can decrease your price by picking a much safer, much less dangerous car. For example, you can prevent automobiles that carry some of the highest opportunities of developing a claim like the Honda Civic, Nissan Altima, and also Toyota Camry.

If your state web traffic authority alerts you that you require the official certificate of responsibility insurance coverage, start searching for means to minimize these plans that are as well typically high-priced.

What is an SR-22? Typically described as "SR-22 Insurance policy", an SR-22 is often needed for vehicle drivers that have actually had their driver's licenses put on hold as a result of: DRUNK DRIVING/ drunk driving convictions Numerous traffic offenses Driving without insurance policy Certificate plates being ended A high number of points on a driving record An SR-22 is a certification of monetary responsibility that is filed with the Illinois Secretary of State's workplace.

United Car Insurance Coverage deals same-day automobile insurance coverage. The certificate notifies the State of Illinois that you have obligation coverage and if your protection is terminated or runs out. As this can be a confusing process, we supplied some solutions to frequently asked questions pertaining to SR-22 Insurance. If you require a quote for your SR-22, please obtain a cost-free quote.

The Ultimate Guide To Insurance Navy Names The Most Affordable ... - Latest News

We will certainly make sure that you have an up to day car insurance policy to go along with the SR-22. Sent directly to the Illinois Secretary of State workplace and also can take up to 30 days to procedure.

Just how much does an SR-22 cost? At UAI, there is not an added price for your Illinois SR22 filing. You need to first purchase Responsibility or Complete Protection insurance as well as the expense will depend on your age, driving document, type of lorry, and added insurance policy elements. Make sure to call United Auto Insurance coverage for a quote on the least expensive rate - credit score.

United Automobile Insurance coverage is the vehicle insurance firm here to assist you with your car insurance policy requires. Obligations are satisfied, the SR-22 status will certainly be removed. At that time, it will be vital to revisit your insurance policy with United Automobile Insurance and make sure that you proceed to remain covered.

United Automobile Insurance Coverage is here for you in the event that you need an SR-22 certificate and also insurance plan. Negative points can occur to excellent people, so we understand that having the best team on your side to help you clear up any type of mistakes is very important. The very best method to take care of an SR-22 requirement is to call us faster instead than later on to stay clear of any kind of higher risks and also recognize that you are covered.

The Best Strategy To Use For Cheap Sr22 Insurance! Only $7/month, Free Quote Here!

This info is meant for academic purposes and is not planned to replace details acquired with the quoting procedure. This details may change as insurance coverage and insurance coverage modification.

Get in touch with your insurance service provider to locate out your state's current requirements as well as make sure you have ample insurance coverage. Just how long do you need an SR-22? Many states require motorists to have an SR-22to verify they have insurancefor about three years. bureau of motor vehicles.

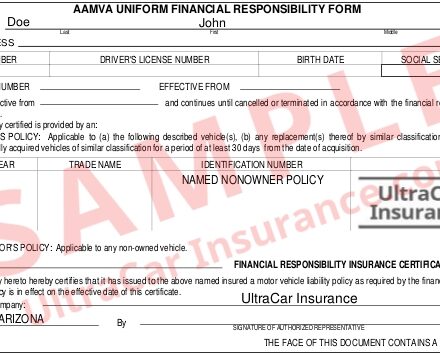

Info Regarding Just How to Get Economical SR22 Insurance Prices Quote Under $7/Month (Mon-Fri, 8am 5pm PST) for a or fill in this form: Materials, SR-22 is a type which confirms to the coverage provided by an insurer. It can also vouch for the posting of personal public bonds. In the last situation, it testifies to the minimum responsibility insurance coverage for the vehicle driver or the lorry enrollment.

In certain states it is required that an SR-22 is carried by the vehicle driver or in the vehicle which is registered. This is a need if the licensee has already been pointed out for gaps in protection or a DRUNK DRIVING. This sort of coverage additionally confirms to have responsibility insurance coverage or operator liability protection.

The 8-Second Trick For Ruger M77 Compact. Features An Engraved Ruger Logo And ...

It is likewise called for to obtain a license back after it has actually been put on hold due to a lapse in coverage. Most states call for that the insurer offer this type in a prompt fashion to update insurance coverage. There are on the internet forms such as the type you see above this page where you will just fill out one kind and you will certainly obtain different quotes from the.

Everybody makes blunders in life. Some individuals have difficulty with their driving record and have actually shed their license at some factor or an additional - sr-22. If your permit was put on hold, then you will be called for to get an SR-22 insurance coverage form prior to getting your certificate renewed by the Division of Motor Automobiles.

If you received a DUI you will certainly be required to get this kind to reinstate a put on hold certificate. insurance companies. If you are called for to get this form your insurance coverage will set you back even more than vehicle drivers with excellent records. SR22 Type, Nonetheless, you must still take a look around for great insurance coverage prices rather of resolving for the least costly solution.

If you are required to get this type because of a DUI conviction it will certainly cost you greater than if you were needed to get the type due to overdue parking tickets - deductibles. You will certainly need to acquire obligation coverage for an auto which you possess if you need to get an SR-22 filing.

The Buzz on Esurance Car Insurance Quotes & More

If you have recently had your certificate suspended or you are considered a "high risk" motorist, but you do not own a vehicle, you can still acquire this kind of insurance coverage under the heading "non-owner insurance coverage". This means that if you rent out a car or borrow a vehicle from your close friend, you still have the insurance coverage you are legally needed to have (underinsured).

credit score sr22 insurance sr22 deductibles bureau of motor vehicles

credit score sr22 insurance sr22 deductibles bureau of motor vehicles

insurance companies underinsured sr22 motor vehicle safety underinsured

insurance companies underinsured sr22 motor vehicle safety underinsured

Difficult, but possible (vehicle insurance). (Mon-Fri, 8am 5pm PST) for a or fill in this kind: Additional reading Many of the moment you will learn that you require this insurance coverage when you are participating in an administrative court hearing after you have had your permit taken away or at facing a probationary driving duration.

Now, you, as the vehicle driver concerned, need to alert your insurance provider that the court has made this request. Now your automobile insurance will file the form formally with your state DMV on your behalf. You can not submit it on your own. The insurance company needs to send it straight.

no-fault insurance auto insurance auto insurance no-fault insurance dui

no-fault insurance auto insurance auto insurance no-fault insurance dui

Electronically submitted types are processed faster than snail mail. Remember to request this from your vehicle insurance policy promptly after a judge or court has actually asked because there are state deadlines for processing it, as well as if the DMV does not refine it in a timely manner because they obtained it late, you are the one who gets penalized.

Getting My Modesto Stolen Cars This Derrel's Location Offers Low-cost Self ... To Work

Do not think twice. Take into account that it can take your DMV as much as 2 weeks to process and ask your insurance coverage how much time it will certainly take them. In order to renew your license you must pay a reinstatement cost and any type of various other fines connected with your driving record.

You should go to the DMV with the form in order to have your permit renewed. Nonetheless, you are called for to maintain the SR22 insurance policy for a marked amount of time. Generally this time around is in between one as well as 3 years but it is essential that you maintain it as long as you require to prevent more fees.

Currently, considering that your insurer is the one in charge of sending the real file, they handle this fee when the filing is done, then they will certainly bill you individually or add the cost to your next insurance policy expense. insurance coverage. In many cases you may be called for to have SR-22 insurance coverage for several years, in which case you only pay a fee once for it to be filed the very first time.

However, be recommended that if there is a lapsemeaning, you did not request for the revival to be refined on timethen you will have to pay once again due to the fact that you will require brand-new evidence of coverage. Generally talking, you will certainly need to have this certification of coverage for 3 years. However, the real size of time is contingent upon: where you live as well as what your state legislations are, andwhy the courts required this insurance coverage of you. bureau of motor vehicles.

Fascination About Sr-22 Insurance: What It Is And How To Get It – Forbes Advisor

insure driver's license driver's license underinsured driver's license

insure driver's license driver's license underinsured driver's license

If there was a much less dangerous factor, it could be just 2 years. The protection remains legitimate for as long as you preserve your insurance plan. If, for any type of factor, you terminate this policy or there was a lapse in between revivals, your auto insurance policy will alert your state authorities.

So, for example, if you are asked to have SR-22 for 3 years, but then you terminate your insurance coverage after 2 years, the state will likely suspend your certificate if it had been formerly suspended. In addition, they will after that press a figurative pause on that 3 year mark and as soon as you determine to buy a new insurance plan in the future, they will certainly begin it up again.